Markets opened with a welcome inflation surprise: January CPI rose just 2.4% y/y (vs. 2.5% expected), the lowest since May 2025, with core at 2.5% as cooler shelter and energy prints pushed June rate-cut odds to 83%. That followed a hotter labor report, 130,000 jobs added vs. 75,000 expected, and unemployment at 4.3%. In tech, AI capex scrutiny erased over $1T in Big Tech value after Amazon projected ~$200B in 2026 spending, pressuring Microsoft, Nvidia, and Oracle; alongside Alphabet and Meta, the group now signals ~$650B in 2026 AI data-center capex (~60% YoY), driving debt issuance and infrastructure strain. Apple fell 5% on reported Siri AI delays and FTC scrutiny. In the consumer-adjacent space, SpaceX reframed its vision toward a self-growing Moon city to bolster its IPO narrative. Semis continue their march toward $1T in 2026 sales (from $791.7B in 2025, +25.6%), led by advanced computing chips (+39.9%).

We’ve published our Monthly AI Deck for January 2026. Check it out here.

Top 5 AI Highlights

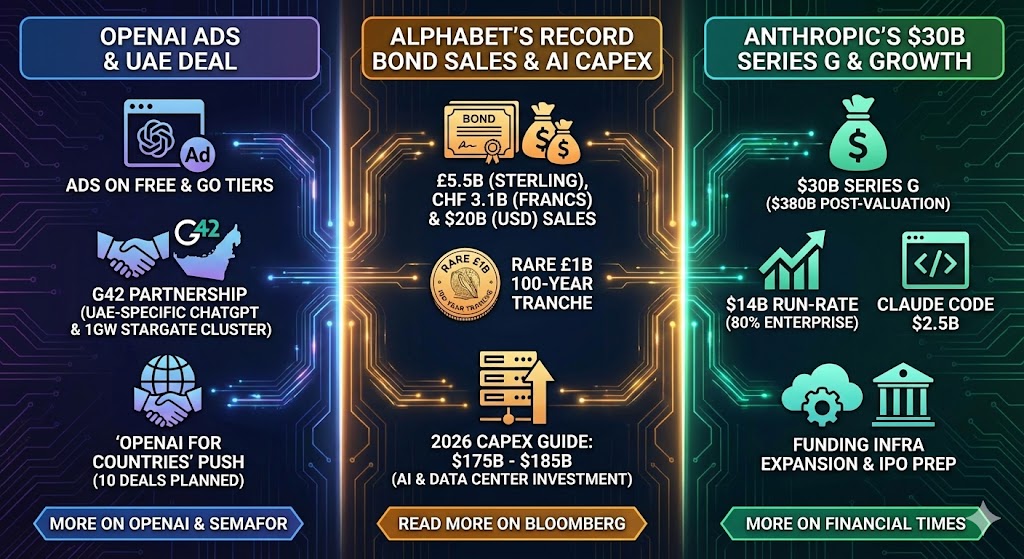

[1] 🎥 OpenAI rolled out ads on ChatGPT Free and Go tiers on Monday, pledging answer independence and privacy, amid consumer backlash and Super Bowl ridicule from rival Anthropic. The company also partnered with Abu Dhabi’s G42 to develop a UAE-specific ChatGPT and launch its first 1GW Stargate cluster, kicking off an “OpenAI for Countries” push with 10 national deals planned. More on ads from OpenAI and details on the UAE deal from Semafor.

[2] 🔎 Alphabet Inc. is issuing record inaugural bond deals of £5.5B in sterling and CHF 3.1B in Swiss francs, approximately $11–12B equivalent, including a rare £1B 100 year tranche, after pricing a $20B USD bond sale earlier this week, raising capital as it guides to $175B to $185B of 2026 capex driven largely by AI and data center investment. Read more about $11B bond sale and $20B bond sale on Bloomberg.

[3] 💰 Anthropic announced its $30B Series G at ~$350B pre-money / $380B post, including part of Microsoft/Nvidia’s prior $15B commitment; with $14B run-rate (80% enterprise) and Claude Code $2.5B, funding infra expansion and IPO prep. More on Financial Times.

[4] 🚗 Apple plans to let third-party voice AI apps run inside CarPlay, allowing ChatGPT-style queries while keeping Siri as default, signaling a strategic opening as AI assistants outpace Siri’s capabilities. Details from Bloomberg.

[5] 🏈 AI’s marketing war spilled onto Super Bowl LX: Svedka touted a mostly AI-made Fembot dance, Anthropic mocked rival AI ads, while Meta glasses, Alexa+, and pet finding tools pitched upgrades, and Ramp, Rippling, Hims & Hers, and Wix joined the automation push. Details on TechCrunch.

✨Open Source AI Development

[1] 🟢 Z.ai launched GLM-5 for complex, long-horizon agentic engineering, scaling to 744B parameters (40B active) and 28.5T tokens, adding DSA for larger context windows and slime RL for asynchronous training, achieving open-source-leading reasoning, coding, and planning performance.

[2] 🤖 Alibaba’s DAMO Academy unveiled an open-source robotics model, “RynnBrain,” built on Qwen3-VL, claiming benchmark wins over Google and Nvidia; the move intensifies the US-China race in physical AI and humanoid robotics. (Bloomberg)

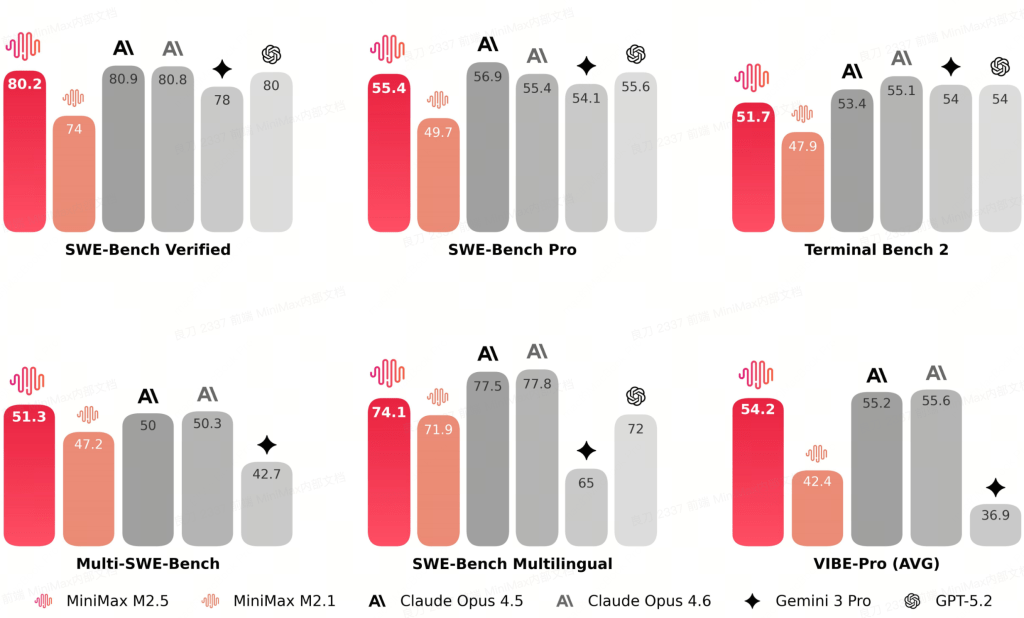

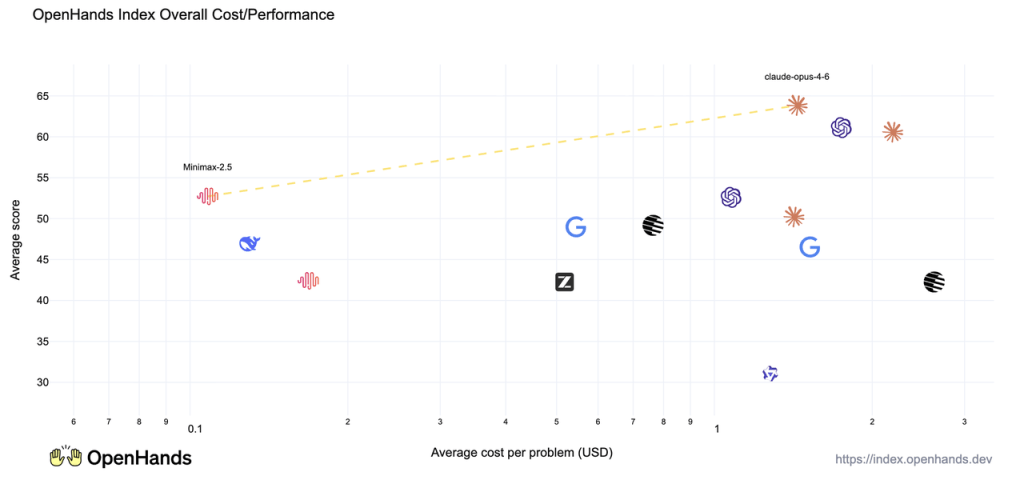

[3] 🥇MiniMax M2.5 delivers SOTA coding and agent performance on par with Claude Opus 4.6 across SWE Bench benchmarks while pricing output at 1/10 to 1/20 of peers. Offers ~60 to 100 tokens per second (TPS), the model’s output speed enables faster responses and higher throughput production deployment. (Minimax)

Source: Minimax

[4] 🧑💻 Top Korean tech firms Kakao, Naver, and Karrot banned open-source AI agent OpenClaw over data-leak and cybersecurity risks, after Wiz flagged flaws exposing user data; concerns center on its autonomous, local access to sensitive systems. (The Korea Times)

[5] 🧩Chile unveiled open-source Latam-GPT, a regional AI model trained on 8TB of Latin American data by 30+ institutions across eight countries, aiming to reduce linguistic bias and boost the region’s AI competitiveness. (Associated Press)

Founder’s Corner

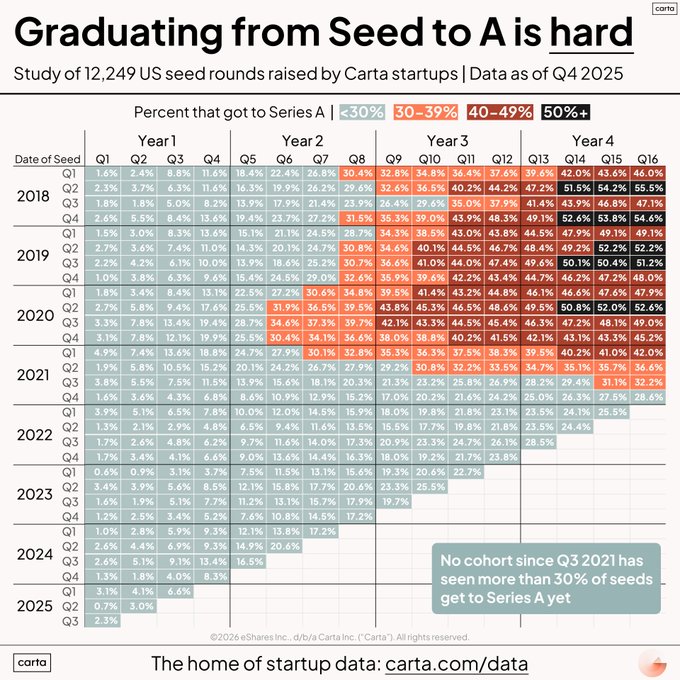

Latest Data on Graduating from Seed to Series A

Source: X

What We Read This Week

- Gemini now lets users import ChatGPT chats to retain context when switching assistants—streamlining transitions, but with privacy tradeoffs as imported data is used to train Google’s models. (Digital Trends)

- ByteDance’s Seedance 2.0 AI video model is generating buzz for creating multi-shot, multilingual scenes with sound. The release highlights China’s growing influence in the competitive global AI video market, as rival companies like Kuaishou have been launching their own generation models. (The Information)

- Apple’s revamped Siri is reportedly facing fresh testing issues, pushing key features from iOS 26.4 to possibly 26.5 or iOS 27; delays dent momentum as Apple races to overhaul AI amid privacy and reliability challenges. (Bloomberg)

- Legal AI startup Harvey is reportedly raising $200 million at an $11 billion valuation, up from $8 billion months ago, driven by surging ARR nearing $190 million and intense VC demand. (TechCrunch)

- Meta’s auditor EY flagged accounting for its $27B Hyperion data-center JV with Blue Owl as a critical audit matter. Meta treats it as a Variable Interest Entity (VIE) but says it’s not the primary beneficiary, keeping assets/debt off-balance-sheet, a judgment EY found especially challenging. (WSJ)

- HBS research shows that AI doesn’t cut workloads; it intensifies them as efficiency raises expectations, pace, and output, leaving employees busier rather than freed for higher-value work. (HBS)

- Workday CEO Carl Eschenbach exited immediately, with co-founder Aneel Bhusri returning permanently as CEO, signaling renewed leadership focus on AI amid workforce cuts and strategic transition. (TechCrunch)

- Discord will require video selfies or ID for full access, defaulting users to teen-restricted settings from March onwards, as platforms face rising regulatory pressure over youth safety. (The Hill)

- Boston Dynamics CEO Robert Playter stepped down after 30 years. CFO Amanda McMaster will become the interim CEO. Playter led the commercialization of Spot and the company’s expansion into humanoid robotics under Hyundai ownership. (TechCrunch)

AI Fundraising News (Feb 6 — Feb 12)

- Accrual: AI accounting automation company, raised $75M

- Algorized: AI people-sensing and perception company, raised a $13M Series A

- Allonic: AI robotic limb manufacturing automation company, raised a $7.2M Pre-Seed

- Andercore: AI cross-border industrial trade platform company, raised a $40M Series B

- Ando: AI workforce forecasting and scheduling company, raised a $4M seed round

- Anthropic: AI foundation model company, raised a $30B Series G

- Apptronik: AI humanoid robotics company, raised a $520M Series A extension

- Archimetis: AI industrial operational reasoning company, raised an $11.5M Seed

- Backslash Security: AI software development security company, raised a $19M Series A

- Biological Computing Co.: AI biological computing systems company, raised a $25M Seed

- Brandlight: AI brand visibility monitoring company, raised a $30M Series A

- Bracket: AI treasury and FX automation company, raised a $7M seed round

- Bretton AI: AI transaction monitoring and compliance company, raised a $75M Series B

- Capalo AI: AI battery optimization platform company, raised a $13.1M Series A

- Cerebras: AI chipmaker company, raised a $1.1B Series H

- Complyance: AI compliance automation platform company, raised a $20M Series A

- Cydelphi: AI digital forensics and ransomware recovery company, raised a $3M seed round

- Databricks: AI data and analytics platform company, raised a $5B Series L

- Daytona: AI agent infrastructure company, raised a $24M Series A

- Didero: AI supply chain automation company, raised a $30M Series A

- Dono: AI property record verification company, raised a $6.5M Seed

- ElevenLabs: AI voice generation company, raised a $500M Series D

- Entire: AI-native code management platform company, raised a $60M Seed

- Ever: AI used EV marketplace company, raised a $31M Series A round

- Fundamental: AI structured data modeling company, raised a $255M Series A

- Galux: AI protein design platform company, raised a $29M Series B

- Gather AI: AI autonomous warehouse monitoring company, raised a $40M Series B

- GitGuardian: AI identity and agent security company, raised a $50M Series C

- Goodfire: AI model interpretability company, raised $150M

- Harvey: AI legal automation company, raised $200M

- Heywa Labs: AI adaptive visual interface platform company, raised a $5M seed round

- Highspot: AI sales enablement software company, raised a $650M

- Lassie: AI pet insurance automation company, raised a $75M Series C round

- Lawhive: AI legal automation company, raised a $60M Series B

- Lema AI: AI supply chain security company, raised a $17.5M Series A

- Maestro AI: AI mortgage origination platform company, raised a $1.2M pre-seed round

- Manufact: AI agent infrastructure platform company, raised a $6.3M seed

- Matia: AI data operations governance company, raised a $21M Series A

- Meridian: AI financial modeling workspace company, raised a $17M Seed

- Monaco: AI sales automation company, raised a $35M seed and Series A

- Montage: AI chip design company, raised $902M

- Mozart AI: AI music creation tools company, raised a $6M Seed

- Neara: AI power grid modeling company, raised a $63.8M Series D

- Newo: AI voice and text agent company, raised a $25M Series A

- OLIX: AI chipmaker company, raised a $220M Series A

- Opaque Systems: AI confidential computing and data security company, raised a $24M Series B round

- Oxide Computer: AI-ready cloud infrastructure company, raised a $200M Series C

- Pelgo: AI career transition platform company, raised a $5.5M seed round

- Positron: AI memory chip company, raised a $230M Series B

- RADICL: AI-native virtual SOC platform company, raised a $31M Series A

- Reco: AI SaaS security monitoring agents company, raised a $30M Series B

- Resolve AI: AI incident response agent company, raised $125M

- Runway: AI video generation company, raised a $315M Series E

- SambaNova: AI chipmaker company, raised a $350M Series E

- Santé: AI retail operations management platform company, raised $7.6M

- Sapiom: AI agent enterprise payments layer company, raised a $15.8M seed

- Seamflow: AI inspection workflow automation company, raised a $4.5M Seed

- Shizuku: AI virtual character company, raised $15M

- Simile: AI human behavior prediction company, raised $100M

- Simple AI: AI voice agent platform company, raised a $14M Seed

- Smart Bricks: AI real estate investing infrastructure company, raised a $5M pre-seed

- Stanhope AI: AI brain-inspired robotics systems company, raised an $8M seed round

- Talkiatry: AI-powered psychiatric care platform company, raised a $210M Series D round

- Tem: AI energy transaction optimization company, raised a $75M Series B

- The Compression Company: AI satellite data compression software company, raised a $3.4M pre-seed round

- Trener Robotics: AI robotics training software company, raised a $32M Series A

- TRM Labs: AI blockchain analytics company, raised a $70M Series C

- Urban SDK: AI geospatial analytics platform company, raised $65M

- Uptiq: AI financial services automation platform company, raised a $25M Series B round

- Vega: AI cloud security threat detection company, raised a $120M Series B

- VillageSQL: AI-assisted database platform company, raised $35M

- Vybe: AI internal app development platform company, raised a $10M seed round

- Winn AI: AI revenue execution platform company, raised an $18M Series A

xWatts: AI building energy optimization company, raised a $2.2M Seed