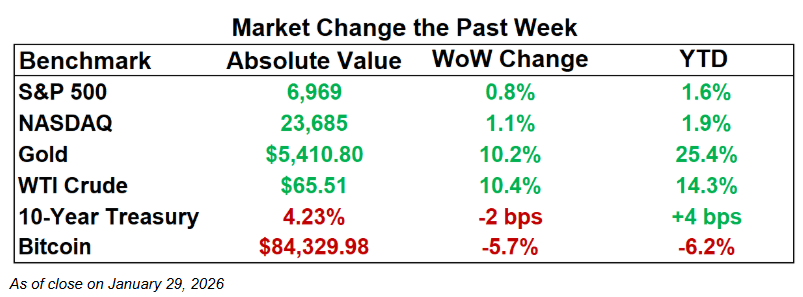

The Fed held rates at 3.50%–3.75%, extending the pause as officials cited still-elevated inflation and solid activity. This morning, President Trump nominated Kevin Walsh as the next Federal Reserve Chair. Separately, the U.S. dollar index slid to a four-year low (around 96) as markets repriced U.S. policy risk. In commodities, safe-haven demand lifted gold more than 10% on the week, pushing deeper into record territory alongside silver. Cost-cutting remained visible in headcount: Amazon cut 16,000 corporate roles, completing a plan for ~30,000 reductions since October. ASML cut ~1,700 jobs (~3.8%) while raising its 2026 sales outlook to €34B–€39B on AI-driven demand. Tesla signaled a product-to-robots shift, saying it will halt Model S/X production to repurpose space for Optimus, alongside >$20B in 2026 capex. At the consumer layer, TikTok’s first weekend under its new U.S.-based JV saw disruptions that Oracle tied to a weather-related data-center power outage. Finally, AI supply chains stayed geopolitical as China conditionally cleared 400,000+ Nvidia H200 chips for imports.

Top 5 AI Highlights

[1] 🦞 Viral open-source AI assistant Clawdbot, now Moltbot, gained 88k GitHub stars and market buzz but faces security risks, early-adopter complexity, and remains best suited for savvy developers. The bot uses Anthropic and OpenAI models to perform tasks ranging from managing your email inbox to downloading voice software and using it to book restaurant reservations. More on TechCrunch, Moltbot, and 1Password.

[2] 🚀 Elon Musk plans to merge xAI with SpaceX ahead of its 2026 IPO, uniting Starlink, Grok AI, and X to power orbital data centers and strengthen Pentagon AI ties. More from Reuters.

[3] 💰 OpenAI is reportedly pursuing a $100B+ pre-IPO fundraising push that could value the company at up to ~$830B, with SoftBank in talks to add up to $30B and OpenAI courting Middle Eastern sovereign wealth funds as additional backers. In parallel, The Information says OpenAI plans premium ChatGPT ads (~$60 CPM) with limited measurement at launch (impressions/clicks), and OpenAI has launched Prism, a free, LaTeX-native workspace for scientists powered by GPT-5.2. More from WSJ, Bloomberg, The Information, and OpenAI.

[4] 💵 Anthropic doubled its VC raise to $20B at a $350B valuation amid surging demand. The company also boosted its 2026 revenue forecast 20%, but delayed cash flow positivity to 2028 due to soaring AI training and operating costs. Read more on The Information and The Financial Times.

[5] 🤖 Google backs Japan’s Sakana AI to expand Gemini’s reach, amid rising AI demand and OpenAI competition; Sakana eyes defense, government, and enterprise sectors after $2.6B valuation and MUFG deals. More from Bloomberg.

✨Open Source AI Development

[1] 💥 Moonshot AI open-sources Kimi K2.5, a 1-trillion-parameter multimodal agentic model that reasons over text, images, and video, supports Instant, Thinking, Agent, and Agent-Swarm modes, and excels in coding with vision and parallel task execution. See more on Hugging Face / Kimi

[2] 🏛️ UAE’s MBZUAI released “K2 Think,” a new open-source “sovereign” model aimed at competing with leading US/China open models, emphasizing transparency (data/algorithms/code disclosures) and efficiency (trained with <2,000 H200s per FT). Details in the Financial Times

[3] 🌦️ NVIDIA launched the Earth-2 family of open weather AI models, positioning it as a fully open toolchain (pretrained models + frameworks + inference libraries) spanning data assimilation → nowcasting → 15-day forecasts, with the debut announced at the American Meteorological Society meeting. Details on NVIDIA’s blog

[4] 🧩 Hugging Face shipped “Daggr,” an open-source Python library for chaining AI workflows (Gradio apps + models + custom functions) with an auto-generated visual canvas for inspecting intermediate outputs and rerunning steps. Details on Hugging Face

[5] 🎬 Skywork open-released SkyReels-V3 inference code + model weights (human-centric video generation), posting both the weights and runnable inference stack on GitHub/Hugging Face on Jan 29, 2026. Details on GitHub / Hugging Face

Founder’s Corner

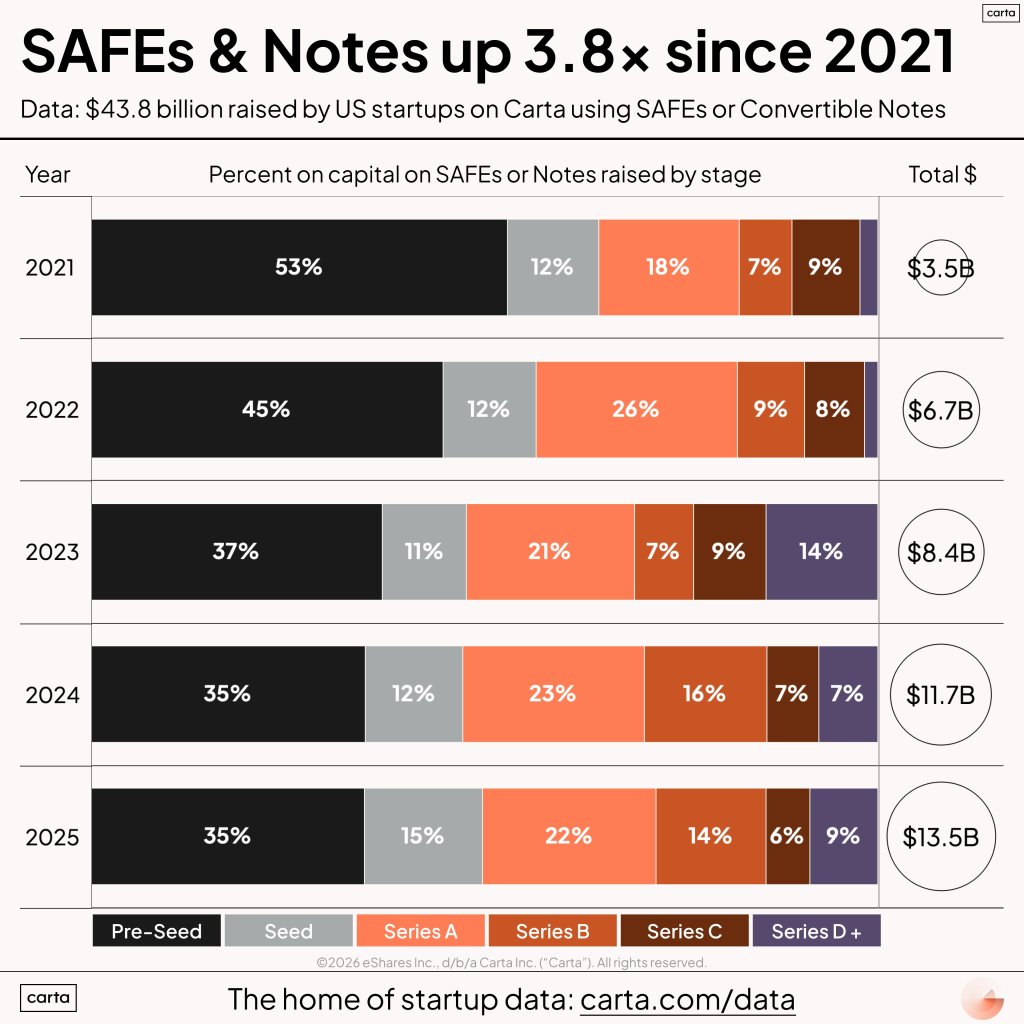

SAFEs & Notes up 3.8x since 2021

Source: X

What We Read This Week

- Nvidia is investing $2B more in CoreWeave to expand AI computing capacity and have CoreWeave be one of the first customers of its standalone Vera CPU, challenging Intel/AMD, while fueling circular financing concerns amid rapid AI infrastructure growth and high-demand forecasts. (Bloomberg)

- Airtable launched Superagent, a standalone AI agent using multi-agent coordination to deliver interactive, data-rich analyses, signaling a bold pivot toward AI-native products amid valuation pressures. (TechCrunch)

- LinkedIn now lets users showcase AI coding skills via integrations with Replit, Lovable, Descript, and Relay.app, with tool-assessed proficiency levels updating dynamically for recruiters and profiles. (Engadget)

- Mozilla is building a “rebel alliance” of startups and nonprofits to promote open, trustworthy AI as a counterweight to OpenAI and Anthropic, investing from its $1.4B reserves to support mission-driven AI innovation. (CNBC)

- The U.S. Army awarded Salesforce a $5.6B, 10-year contract, providing AI-enabled software and Slack access to modernize recruiting, streamline procurement, and accelerate defense decision-making through commercial technology adoption. (WSJ)

- Start-up Mercor has been in the news. The company employs 30,000 experts, paying $2M daily, to train AI in professional tasks, creating high-paid gig work while raising long-term concerns about future job displacement. (The Financial Times)

- Amazon is closing Amazon Go and Fresh stores to expand Whole Foods and online grocery delivery, scaling Same-Day perishable delivery, launching 100+ Whole Foods locations, and innovating faster, convenient shopping experiences. (Amazon)

- Zoom shares jumped 11% as Baird estimated its $51M investment in AI startup Anthropic from 2023 could now be worth $2–4B, potentially yielding a 78x return amid IPO speculation. (CNBC)

- Spotify paid $11B in 2025 royalties, surpassing $70B all-time, with half going to indie artists. CEO Charlie Hellman called it history’s largest annual music payout and highlighted upcoming AI protections. (The Hollywood Reporter)

- TikTok star Khaby Lame signed a $975M deal with Hong Kong-based Rich Sparkle to monetize his 360M followers, including brand rights, co-branded products, and an AI version of himself, targeting $4B annual sales. (Bloomberg)

Special Earnings

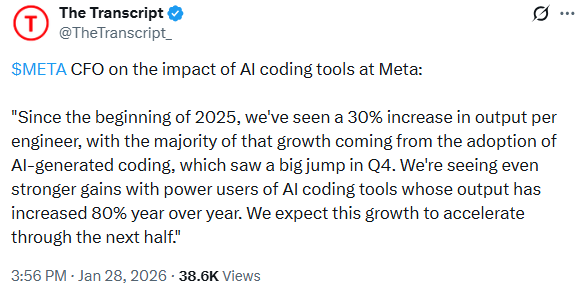

- Meta (Q4’25 / FY’25): Revenue rose 24% YoY to $59.9B (FY revenue $201.0B, +22%), driven by ad growth; management highlighted stepped-up AI infrastructure capex (Q4 capex $22.1B, FY capex $72.2B) as it scales personalization + genAI products. (Meta)

- Microsoft (FY26 Q2): Revenue grew 17% YoY to $81.3B with operating income +21% to $38.3B; Azure +39% as AI + cloud demand continued, and Microsoft returned $12.7B via buybacks/dividends. (MSFT)

- Apple (FY26 Q1): Revenue increased 16% YoY to $143.8B with EPS $2.84; iPhone revenue $85.3B (+23% YoY) and Services $30B (record), with a notable rebound in China sales (+38% YoY). (Apple)

- Tesla (Q4’25 / FY’25): Tesla reported $24.9B Q4 revenue and $0.50 EPS, with Q4 free cash flow ~$1.4B; FY revenue was $94.8B (-3% YoY) as the company emphasized an accelerating pivot toward AI/robotics and robotaxi initiatives. (TSLA)

AI Fundraising News (Jan 23 — Jan 29)

- Adaptive6: AI-driven cloud cost governance platform that flags waste as security-style vulnerabilities in CI CD workflows, raised $28M Series A

- Agileday: AI-powered project and staffing management platform for professional services firms, raised $7.6M Series A

- Clay: AI sales startup, raised $5B

- Compa: AI-driven compensation intelligence platform using real-time pay data from enterprise systems, raised $35M Series B

- Concourse: AI agent platform for corporate finance teams to automate workflows and analysis, raised $12M Series A

- CoreWeave: AI cloud computing firm, raised $2B

- CVector: AI-based industrial optimization platform that models how operational actions impact costs and margins, raised $5M Seed

- Decagon: AI-powered customer service agent platform for enterprises, raised $250M Series D

- DeepWay: AI-powered autonomous trucking company, raised ~$173M Pre-IPO round

- Factify: AI-native document standard that replaces PDFs with structured records optimized for machine reading and automation, raised $73M Seed

- Flapping Airplanes: AI research lab focused on data-efficient training methods to reduce compute needs for frontier models, raised a $180M round

- Flora: Generative AI node-based design tool for creating media assets, raised $42M Series A

- Fulcrum: AI-powered workflow automation platform for insurance brokerages across policy checks and proposal generation, raised $20M Series A

- Inferact: AI infrastructure startup building on vLLM, raised $150M

- Jelou: AI-powered conversational payments platform enabling identity checks and account actions inside WhatsApp, raised $10M Series A

- Kime: AI search visibility analytics platform that tracks how brands appear in AI-generated answers, raised $2.4M Pre-Seed

- Lucend: AI-driven analytics platform that uses sensor and operational data to improve data center efficiency and uptime, raised $3.3M Seed

- Midship: Agentic AI platform that automates SOX testing and internal audit workflows, raised $4.15M Seed

- Mine: AI-powered credit card and financial planning platform for young adults, raised $14M Series A

- Orbital: AI and geospatial due diligence platform that automates document review for real estate transactions, raised $60M Series B

- Outtake: Autonomous AI agents that detect and remove cyberthreats and impersonation attacks across digital channels, raised $40M Series B

- Pace: Agentic AI platform that automates document-heavy insurance operations, raised $10M Series A

- PaleBlueDot: AI compute marketplace that brokers GPU capacity and designs enterprise GPU clusters, raised $150M Series B

- Phia: AI shopping app that finds cheaper resale and alternative products while users browse, raised $35M Series A

- Pixellot: AI-powered automated sports video production and streaming platform for youth and amateur sports, raised $15M Growth round

- Ricursive Intelligence: AI system to design/improve AI chips, raised $300M

- Salvo Health: AI-enabled monitoring platform supporting hybrid gastrointestinal and metabolic care, raised $8.5M Series A

- Slice: AI agent platform that encodes tax policies and legal rules across 60+ countries for equity compliance, raised $25M Series A

- SpotDraft: On-device AI contract review and editing platform that keeps sensitive data off the cloud, raised $8M Series B Extension

- StepFun: LLM developer building multimodal AI models for consumer devices and enterprise partners, raised ~$717M Series B+

- Summize: AI contract intelligence platform that manages workflows inside tools like Slack and Microsoft Teams, raised $50M Growth round

- Synthesia: AI-generated video platform for enterprises, raised $200M Series E

- Tandem: AI automation platform for prescription paperwork and pharmacy routing, raised $100M Series B

- Tradespace: AI-driven patent and invention disclosure platform with legal-grade redaction, raised $15M Series A

- Upwind: AI-powered cloud security platform that filters false alerts using runtime data, raised $250M Series B

- Vention: Physical AI platform that uses AI to design, configure, and run robots and automated machines in factories, raised $110M Series D

- Visitt: AI platform that automates commercial property operations and maintenance workflows, raised $22M Series B

- Waabi: AI-first autonomous driving platform for trucking and robotaxis, raised $750M Series C

- Zocks: Privacy-first AI assistant for financial advisers that extracts and organizes client information from conversations, raised $45M Series B