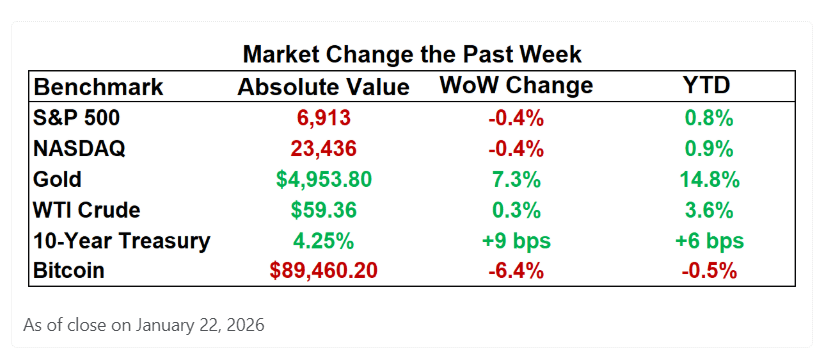

Markets opened on edge this week as politics, policy, and AI power struggles collided. Macro-wise, global stocks whipsawed after Trump’s renewed rhetoric about asserting control over Greenland briefly eased and then reignited trade fears, keeping volatility high, lifting gold, and leaving investors wary of EU retaliation and broader geopolitical risk. In Washington, the Supreme Court signaled strong support for Federal Reserve independence, expressing skepticism toward Trump’s attempt to fire Fed Governor Lisa Cook without due process and letting lower-court protections stand. At the consumer and workforce level, Bank of America hired 2,000 Gen Z graduates from a 200,000-strong applicant pool, with CEO Brian Moynihan urging optimism amid AI disruption and downplaying rate angst in favor of private-sector momentum. Finally, AI drama intensified as Sam Altman and Elon Musk reignited their public feud over the safety of ChatGPT and Tesla Autopilot, lawsuits, and OpenAI’s for-profit shift.

Top 5 AI Highlights

[1] 💰 OpenAI is raising $50B as CEO Sam Altman courts Middle Eastern sovereign wealth funds, targeting an $830B valuation to fund expansion amid intensifying global AI competition. More from Bloomberg.

[2] 💬 ChatGPT Go expands globally at $8/month as OpenAI begins testing ads in the U.S. while keeping premium tiers ad-free. Separately, ChatGPT is rolling out age prediction to protect minors ahead of adult content. More from OpenAI and Reuters.

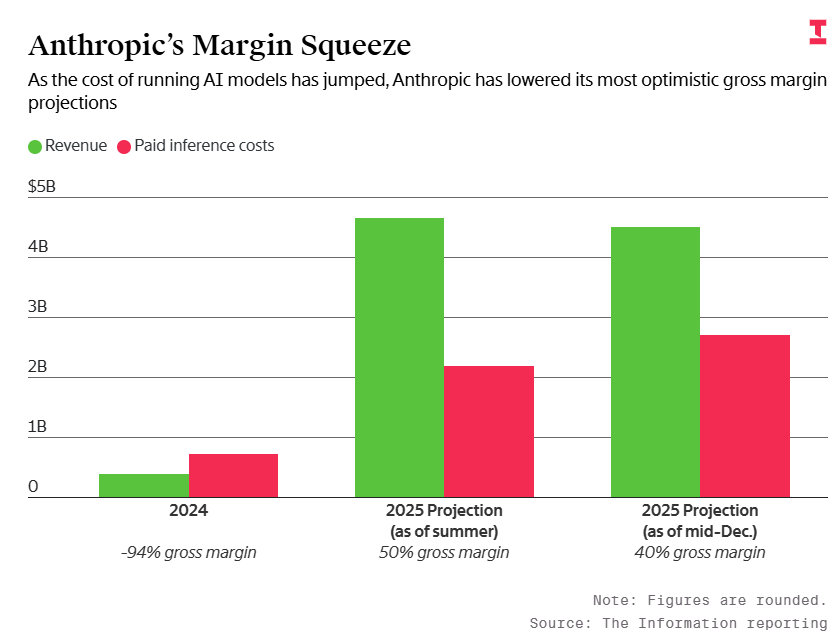

[3] 🤖 “It’s like selling nuclear weapons to North Korea,” Anthropic CEO Dario Amodei said at Davos’ World Economic Forum in January 2026, slamming U.S. approval of AI chip exports to China. Anthropic’s revenue run rate hit $9B, while gross margins fell to 40% amid rising inference costs. More from Bloomberg and The Information

[4] ⚖️ Elon Musk demands up to $134B from OpenAI and Microsoft, claiming wrongful gains from his early support; both companies deny the claims, with a jury trial set for April 2026. OpenAI counters Musk’s $134B lawsuit, accusing him of bad-faith tactics to regain control; it cites past emails showing Musk supported converting OpenAI to a for-profit before departing in 2018. Info on CNBC and OpenAI.

[5] 📌 Apple is developing an AI-powered wearable pin, AirTag-sized, with cameras and microphones, targeting a 2027 launch to compete with OpenAI and Meta, with potential for 20 million units. The company is also planning to significantly update Siri with generative AI chatbot functionality in 2026, with Google Gemini providing the core AI technology (as we discussed last week). Apple shares rose 1.7% on the news. Meanwhile, OpenAI is seeking U.S. suppliers for its robotics and AI device push, planning trillions in data center investment and sourcing silicon, motors, and cooling gear. See more on the Wearable Pin, Siri Plans, and OpenAI’s device.

✨Open Source AI Development

[1] ⚡ China’s Z.ai launches GLM-4.7-Flash, a 30B parameter open-source model excelling in coding and math benchmarks, outperforming peers like Qwen3-30B with fast performance, free API access, and Hugging Face availability. See more on X.

[2] 💰 Inferact raised a $150 million seed round at an $800 million valuation to build on vLLM, an open-source system that makes running AI models faster and cheaper during inference. The funding round was led by Andreessen Horowitz and Lightspeed Venture Partners. Details on Bloomberg.

[3] 🐦 X re-open-sourced its recommendation algorithm, detailing Grok-powered AI feeds, as it faces EU transparency fines and scrutiny over Grok misuse, fueling debate over whether the move reflects genuine openness. More on TechCrunch.

[4] 🪿Goose, an open-source, free, local AI coding agent by Block (formerly Square), is gaining popularity as it offers similar functionality to Anthropic’s $20–$200/month Claude Code, giving developers offline access, no limits, and full data control. See VentureBeat for info.

[5] 🌍 At the World Economic Forum, open-source AI took center stage as former Google CEO Eric Schmidt urged Europe to invest in open-source AI and energy infrastructure, warning that without funding, it will rely on Chinese models, risking technological dependency and reduced global competitiveness. Check out Bloomberg for details.

Founder’s Corner

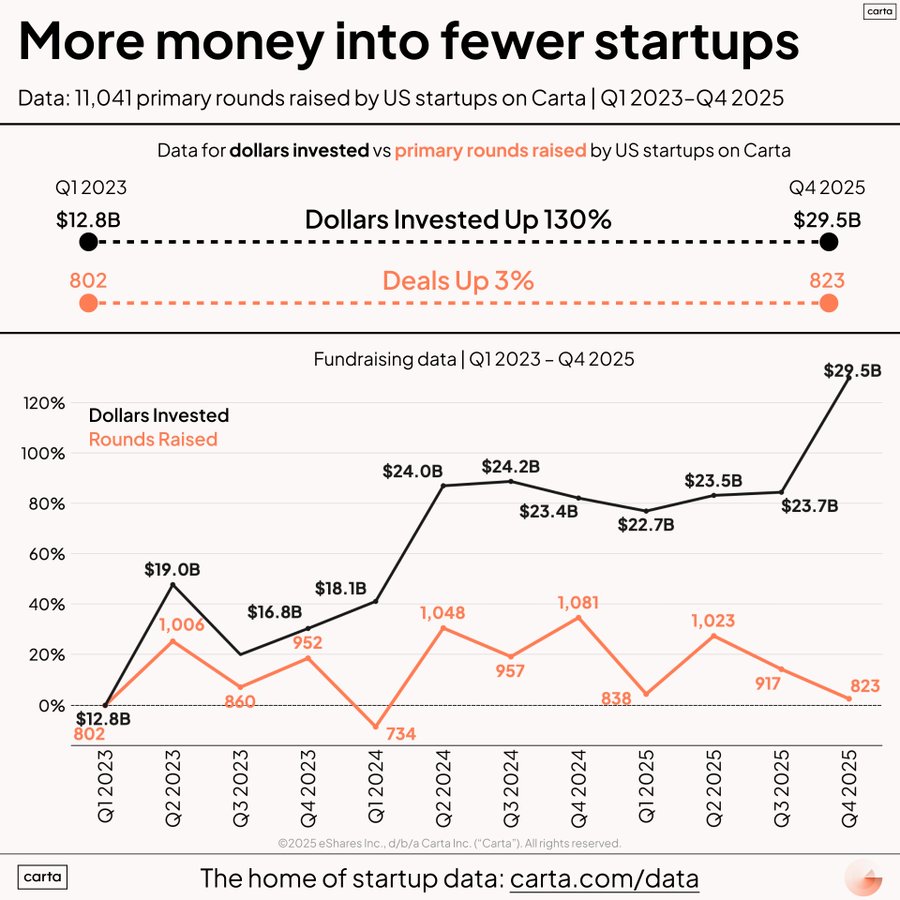

Investments Exploded While Deal Count Stayed Put

Source: X

What We Read This Week

- OpenAI and ServiceNow ink a three-year deal to embed AI agents in ServiceNow software, enabling automated IT tasks, AI voice tools, and multimodal workflows, boosting enterprise AI adoption and operational efficiency. (WSJ)

- Thinking Machines is actively trying to raise funding at a $50B valuation, but is facing pressure after internal turmoil. Slow product rollout, investor concerns, and a leadership clash between CEO Mira Murati and CTO Barret Zoph, sparked by disagreements over company direction and Murati’s rejection of a Meta acquisition, led to Zoph’s firing. His exit triggered mass defections to OpenAI, casting doubt on the startup’s future. (NY Times)

- Capital One is acquiring Brex for $5.15B in cash and stock, expanding into AI-native finance software. Brex’s CEO will stay post-merger; deal expected to close mid-2026. (Capital One)

- Grubhub parent Wonder acquired restaurant rewards startup Claim, adding cash-back and personalized promotions to boost merchant retention and diner savings; terms undisclosed, Claim previously raised $20 million. (TechCrunch)

- FTC Chair Andrew Ferguson said the agency is scrutinizing Big Tech “acqui-hires” to prevent antitrust evasion, signaling tougher oversight of AI partnerships and talent deals under the Trump administration. (Bloomberg)

- Wing and Walmart to expand drone delivery to 150 more stores nationwide, reaching 40M Americans by 2027; rapid adoption in Dallas and Atlanta drives coast-to-coast rollout across major U.S. metros. (Wing)

- Gemini Enterprise hits 8M subscribers and 85B monthly API calls, more than doubling since March, driven by developer adoption and cloud integration—boosting Alphabet’s AI positioning and revenue. Discussions on X.

- Google expanded its AI videomaker Flow to Workspace Business, Enterprise, and Education users, enabling eight-second AI video generation with advanced editing, audio, and vertical video tools. (The Verge)

- Google warns grid connection delays of up to 12 years are now the biggest bottleneck for AI data center growth, as power constraints replace chips as the limiting factor. (Network World)

- Target is increasingly integrating AI across stores, e-commerce, operations, and advertising. The technology is being used to boost employee productivity, personalize shopping, improve inventory accuracy, and scale its $2B+ Roundel retail media business. (Neatprompts)

AI Fundraising News (Jan 16 — Jan 22)

- AheadComputing: AI-optimized RISC-V CPU architecture for data centers and high-performance computing, raised $30M Seed

- Baseten: AI model deployment and production inference platform for code generation, search, and automation, raised $300M Series D

- Bolna: AI voice agent orchestration layer for Indian enterprises, raised $6.3M Seed

- Cambio: AI-powered commercial real estate software for institutional investors, raised $18M Series A

- ClickHouse: Real-time analytics database and data infrastructure for AI workloads and observability, raised $400M Series D

- Dam Secure: AI-native security platform focused on preventing logic flaws in AI-generated code, raised $4M Seed

- Datarails: AI-native finance and FP&A platform built for Excel-centric teams, raised $70M Series C

- ElevenLabs: AI voice-generation platform for realistic speech, in talks to raise at a $11B valuation

- Emergent: AI-powered platform for designing, building, testing, and deploying web and mobile applications, raised $70M Series B

- Ethernovia: Ethernet packet processors optimized for real-time sensor, control, and AI data in autonomous systems, raised $90M+ Series B

- Furl: Agentic AI security platform for automated investigation and remediation across endpoints and servers, raised $10M Seed

- Humans&: Collaborative AI systems designed to coordinate humans and AI agents across workflows, raised $480M Seed

- Ivo: AI-powered legal review platform structured around hundreds of specialized analysis tasks, raised $55M Series B

- Karman Industries: Modular thermal infrastructure designed for giga-scale AI data centers, raised $20M Series A

- Listen Labs: AI-first customer research and interview platform for product decision-making, raised $69M Series B

- Mave: AI platform supporting real estate brokerages with agent workflows and decision support, raised $5M Seed

- Musical AI: AI-based attribution technology ensuring rights holders are compensated for AI-generated music, raised $4.5M Seed

- Neurophos: Photonic AI processors using optical compute to replace GPUs in training and inference, raised $110M Series A

- Nexxa.ai: Specialized AI agents designed for automation in heavy industrial environments, raised $9M Seed

- OpenEvidence: AI clinical decision-support chatbot trained on peer-reviewed medical research for physicians, raised $250M Series D

- Otto Sport AI: AI-powered youth sports management software for clubs, leagues, and tournaments, raised $16.5M Seed

- Runpod: AI app hosting with GPU/serverless options, raised $20M

- SambaNova: AI chip and systems platform for enterprise model inference and deployment, seeking to raise $300M to $500M

- Upscale AI: Integrated AI infrastructure combining GPUs, memory, storage, and networking for large-scale workloads, raised $200M Series A

- XBuild: AI-powered estimating and proposal software for residential construction contractors, raised $19M Series A

- Zanskar: AI-driven geothermal exploration platform for identifying overlooked power-generation sites, raised $115M Series C