After a month-long trip to China this August, I found myself reflecting on the rapid pace of technological change and how much of it is shaped by China’s state-managed economy. As I rest on my flight back to the U.S., I could not help but notice how different the consumer experience felt, from transportation to AI, compared to what I am used to at home.

Booking Travel in a Different System

One of my first surprises came while booking flights for a short trip with my wife. She casually said we did not need to book weeks in advance because prices would stay the same even a day before departure. This is almost unthinkable in the U.S., where last-minute fares usually skyrocket. It turns out this stability is partly because many of China’s major transportation companies, including airlines, high-speed rail, and bus networks, are state-owned or heavily regulated. The focus is on accessibility and predictability for the general public rather than profit alone.

Search Result on Ctrip.com for a plane ride from Beijing to Shanghai for demonstration purposes, the price ranges from $56 to $80.

This is one of the ways “Socialism with Chinese Characteristics” shows up in daily life. State-owned enterprises manage the “strategic” sectors, but private companies still thrive in most other areas with significant government support.

EVs Everywhere – and Affordable

The difference it makes was even more visible on the roads for EVs. Everywhere I looked, electric vehicles (EVs) were common, from compact city cars to high-end models with luxurious interiors. DiDi (China’s version of Uber) kept sending me rides in EVs with their signature green license plates.

The green license plates are EVs, and traditional cars have blue license plates. Source: SCMP.

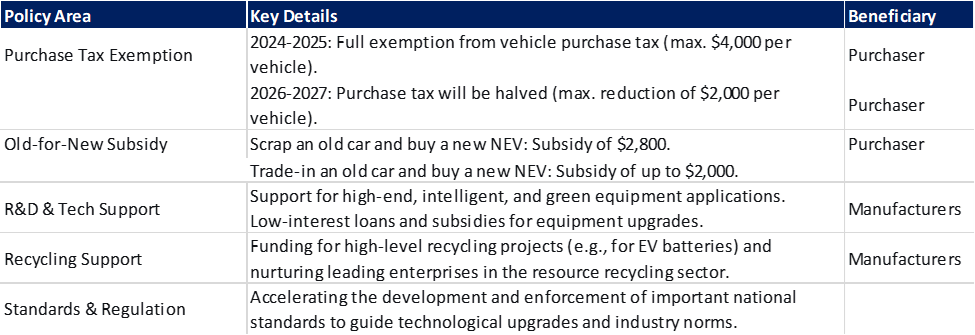

The range of choices is impressive. You can get a capable EV for around $10,000, while premium brands like Huawei’s Aito offer feature-packed cars closer to $20,000. The affordability, paired with government subsidies and one of the world’s densest charging networks, has helped China capture over 60% of global EV sales in 2024.

Picture of the $8,000 BYD Seagull, and you can walk a video of someone test driving it here.

Even tech companies outside the auto industry are getting involved. Xiaomi, best known for its smartphones, released its SU7 EV after just five years of development, which is a remarkable feat. It stands in stark contrast to Apple’s decision to wind down its decade-long Project Titan and pivot back to software like CarPlay.

This affordability, along with government subsidies and an aggressive charging infrastructure rollout, has made China the world’s largest EV market by far, accounting for more than 60% of global EV sales in 2024.

One of my most memorable rides was in a Li Auto L6, which had a gorgeous in-car display. My friend showed me that you can use the car’s cameras to park automatically, stream a movie on the passenger screen, and even remotely “inch” the car forward if someone parks too close to your driver’s side door. It was one of those moments that made me think: “This is the future, and it’s already here.”

Picture of Li Auto’s Li6 In-car display

The speed and scale of China’s EV rollout is so striking that Ford’s CEO Jim Farley recently said Chinese EV makers are “dictating the rules” of the global market. It is hard not to feel that the rest of the world is racing to catch up. A recent report from the International Energy Agency highlights the latest trends in the electric car industry, showing the demand and supply by major regions globally. With demand comes the need to innovate and fund research.

- United States – Production: 1.1 million, Demand: 1.6 million

- People’s Republic of China – Production 12.4 million, Demand 11.2 million

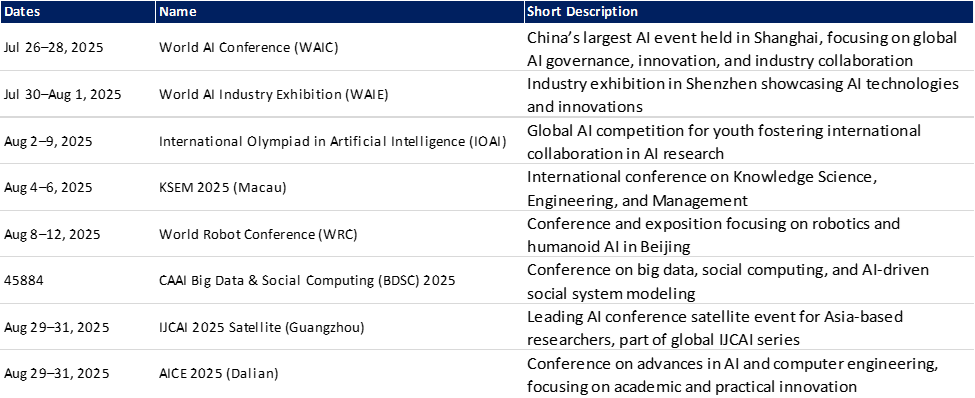

The AI Push – Everywhere You Look

China’s push into AI is hard to miss. State media like CCTV regularly highlight how AI is being used to improve agriculture, manufacturing, and travel logistics. The government has poured resources into building AI infrastructure and hosting global conferences to attract talent and investment. The emphasis is on commercialization, making AI part of everyday life, not just a research project.

I experienced this first-hand while planning my trip. I used Doubao (ByteDance’s ChatGPT rival) and Kimi (from Moonshot AI) extensively, not just for itinerary planning, but for day-to-day use, such as understanding the test results from my physical exam and finding the right diet and behaviors to improve the conditioning of my body.

The Original Doubao advertisement translated and re-generated by ChatGPT

AI features were also showing up in every app I used. Alipay integrated AI chatbots that helped with everything from bill payments to travel bookings. China Mobile’s app used AI to manage data plans and offer recommendations for entertainment and services. Taobao, Alibaba’s massive e-commerce platform, had AI-powered shopping assistants that suggested products and helped me find exactly what I was looking for. It felt like AI was not just an add-on — it was becoming the default way to interact with these platforms.

AI Learning Machine made by iFLYTEK, which was born out of the University of Science and Technology of China. Its slogan is Team China representative for AI.

Privacy and State Monitoring Concerns

Of course, the other side is that all this technology is closely monitored. Conversations on Doubao and Kimi are filtered for sensitive topics. Smart cameras with facial recognition are common in public spaces and are often tied into government databases.

This made life very convenient — payments were instant, transportation felt seamless — but it also made me pause and think about how much data was being collected. As a visitor, it was fascinating to observe. As a parent, it made me wonder what trade-offs I would be willing to make if I lived there permanently.

Balancing Innovation and Individual Rights

That tension between speed and control was one of my biggest takeaways. In the U.S., innovation is driven by market forces and increasingly shaped by privacy regulations like California’s CCPA. In China, adoption happens quickly because there is a clear mandate from the top. Citizens benefit from innovative tech sooner but often gives up some degree of privacy in exchange.

Final Thoughts

Seeing all this firsthand made me curious about what lessons the U.S. might take from China’s approach. The same level of support that kept airfare prices stable and put EVs on every corner is now being applied to AI. There is room for the U.S. to consider more public-private partnerships, more investment in compute infrastructure, and more training programs to prepare the workforce for an AI-driven economy.

It is not a call to copy China’s model, but it does feel like an opportunity to think bigger about how quickly we can make recent technologies accessible. For investors, it might be worth keeping an eye on sectors like cloud infrastructure, semiconductors, cybersecurity, and healthcare AI — areas likely to grow if policy shifts toward enabling AI innovation.

What struck me most was how technology can reshape everyday life when government, industry, and consumers are all moving in the same direction. The challenge for both China and the U.S. will be finding the sweet spot between innovation, speed, and privacy.