We recently hosted an informative webinar designed for the portfolio companies of a leading venture capital firm. The session focused on demystifying the basics of mergers and acquisitions (M&A) for founders and executives. We understand that for many, the concept of an M&A transaction might seem complex or far off in the future. However, gaining a foundational understanding can be extremely valuable, whether you’re preparing for growth, considering a strategic partnership, or simply exploring the potential paths your business might take.

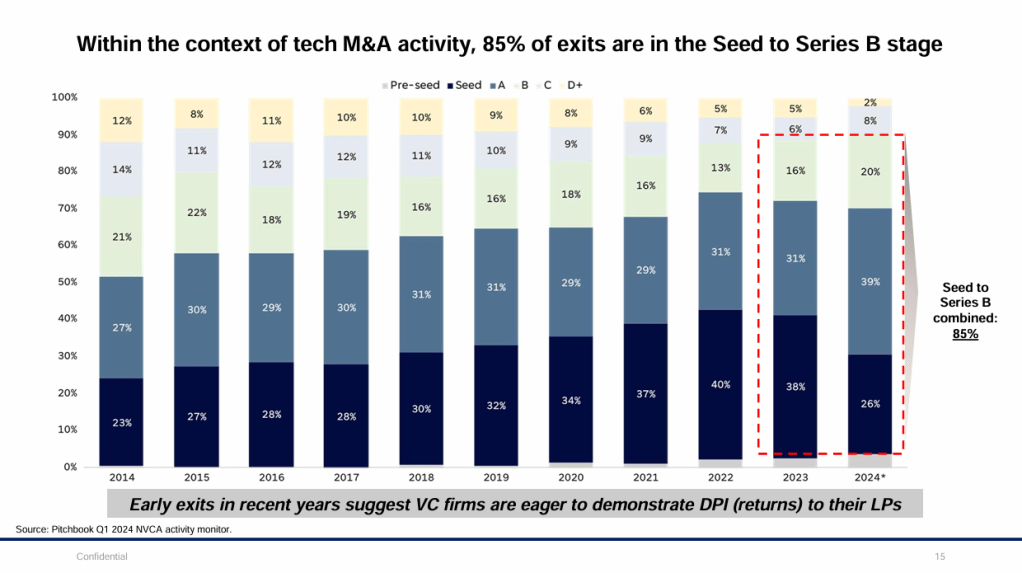

Before we dive in, it’s crucial to consider the economic factors affecting the current market. Over the past two years, high interest rates have increased borrowing costs, while global market volatility has added uncertainty to financial planning. 85% of tech M&A exits are in the Seed and Series B stages—highlighting the pressures on venture capital firms to deliver returns. Understanding these dynamics is key to navigating the M&A landscape effectively.

During the webinar, we covered several key topics to provide a well-rounded overview of the M&A process:

Understanding the Buyer Landscape

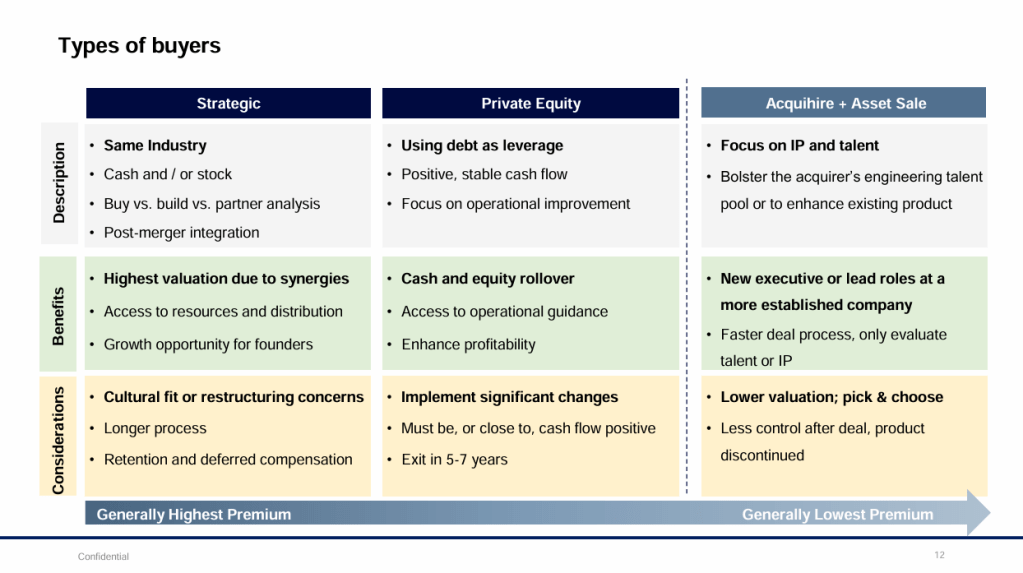

One of the first topics we covered was the different types of potential acquirers. While many founders immediately think of large tech companies or industry competitors as the only potential buyers, the landscape is actually quite diverse. We discussed the difference between strategic buyers (often larger companies looking to expand their market reach or capabilities) and financial buyers (such as private equity firms looking for investment opportunities). We discussed:

– Strategic buyers: Established companies looking to expand their capabilities or market presence

– Financial buyers: Private equity firms and investment funds

– Hybrid buyers: Private equity firms with existing portfolio companies in related industries

Why Companies Make Acquisitions

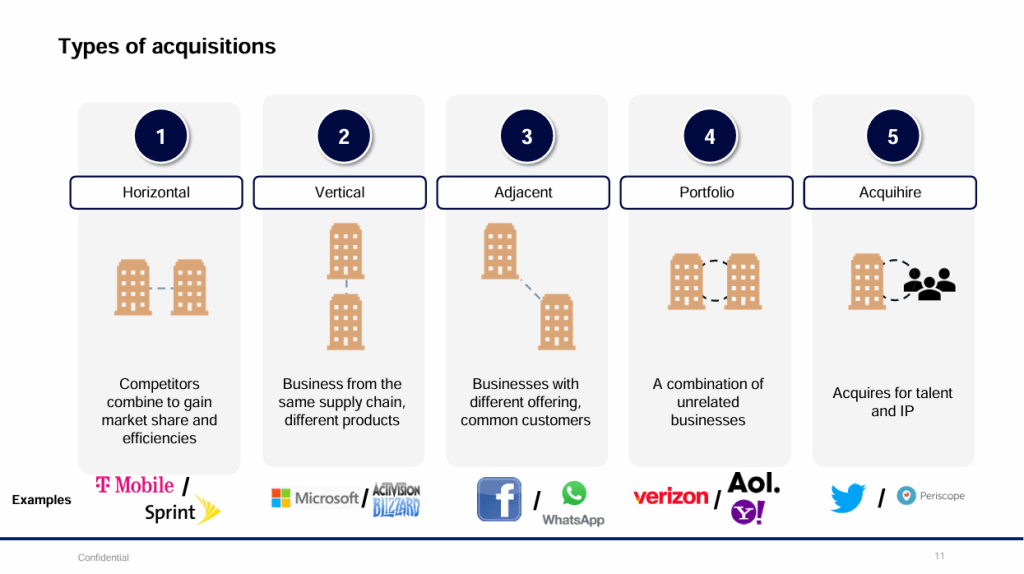

We explored the various reasons why larger companies might be interested in acquiring smaller ones. Understanding these motivations can help founders position their companies more effectively. Common rationales include:

– Expanding into new markets or geographies

– Acquiring innovative technology or intellectual property

– Adding talented teams quickly (often called “acqui-hires”)

– Eliminating future competition

– Achieving economies of scale

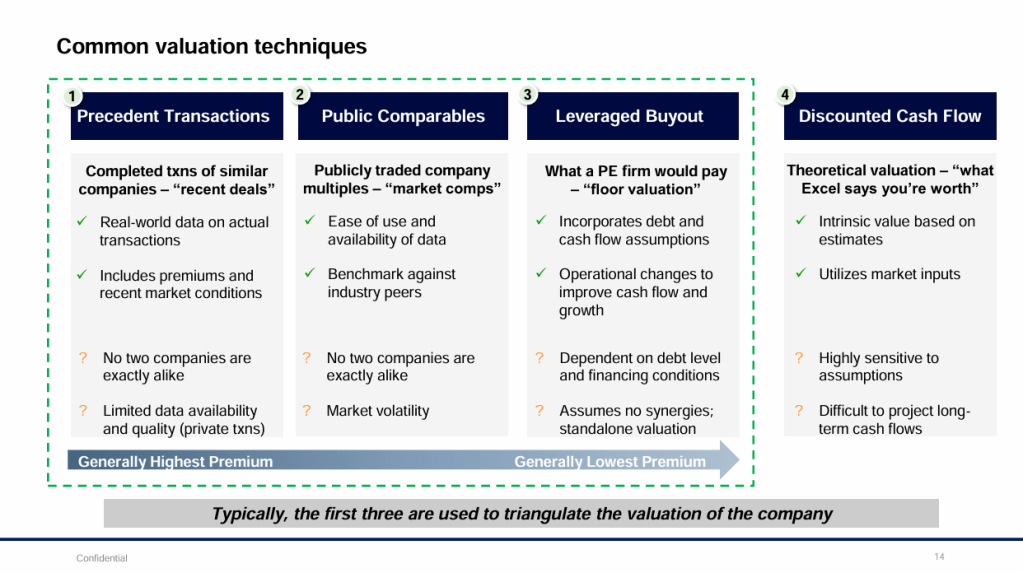

Valuation: More Art Than Science

Perhaps the most anticipated portion of the webinar focused on how companies are valued during M&A processes. We explained that while there are several technical methods to value a business, the final offer often depends on multiple factors, including:

– Market conditions and timing

– Competitive dynamics in the process

– The strategic value to specific buyers

– Growth prospects and risks

– Quality of revenue and customer relationships

Common valuation methods are Comparable Companies Analysis, Precedents Transactions, Leveraged Buyout (LBO), and Discounted Cash Flow (DCF) Analysis. As your investment banker partner, we’re happy to discuss any of these valuation methods in detail with you. Just reach out to the contacts at the end of this post.

Preparation Checklist

Finally, we provided a preparation checklist to guide companies on the steps they should take if they decide to explore an M&A transaction. The practical steps companies can take to prepare for a potential M&A process, even if it’s not an immediate priority are:

1. Keep your corporate house in order

– Maintain clean financial records

– Document all contracts and agreements

– Protect intellectual property

2. Build and maintain good data practices

– Organize key metrics and KPIs

– Document important processes

– Keep customer information current

3. Focus on sustainable growth

– Develop diverse revenue streams

– Build strong customer relationships

– Maintain healthy unit economics

Looking Ahead

The engaged discussion and thoughtful questions from attendees highlighted the value of demystifying the M&A process for growing companies. While an acquisition may not be every company’s goal, understanding the basics of M&A can help founders make more informed strategic decisions as they scale their businesses.

The goal of the webinar was to make M&A concepts accessible and provide actionable insights, whether you’re considering an exit now or simply preparing for the future. We were thrilled with the level of engagement and the thoughtful questions from the participants.

If you’re interested in learning more about the M&A process or how to best position your company for future growth, feel free to reach out. We’re always here to help simplify the journey.

—

If you’re interested in diving deeper, click the link here for a copy of the slide deck we shared during the webinar.

Want to learn more about M&A preparation? Reach out to jay@stepmark.ai and da@stepmark.ai for additional resources and guidance.